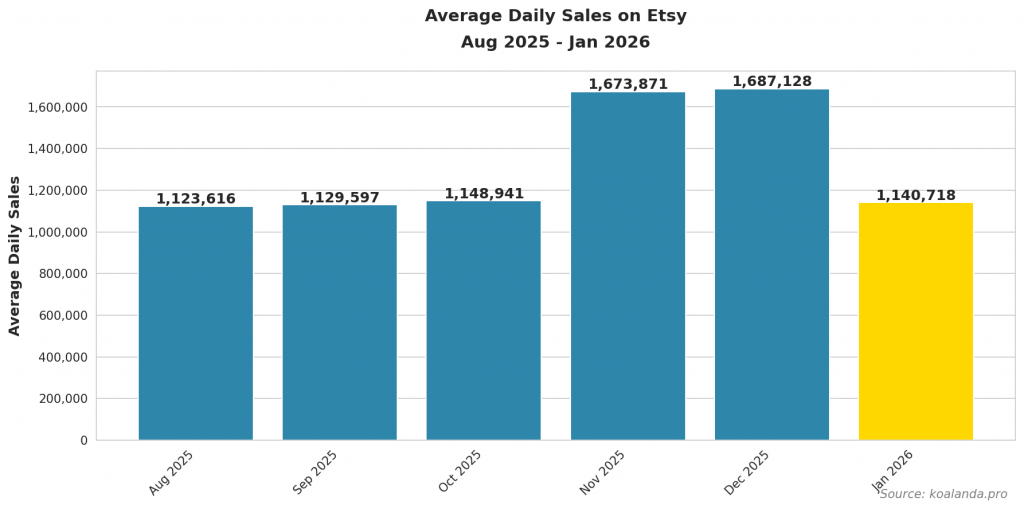

The Etsy Sales Report for January 2026 shows a sharp post-holiday reset: average daily sales fell to 1,140,719, down from 1,687,129 in December, a 32.4% month-over-month decline. That drop is not surprising after peak gifting season, but the size of it matters because it changes how quickly sellers need to pivot from holiday demand to Q1 demand. The main story this month is uneven cooling: overall volume dropped hard, yet some categories and countries held up better than others, and new shop creation remained high at 126,062, which adds yet more competition on Etsy.

Table of Contents

Sales on Etsy in comparison with previous months

January’s average daily sales landed at 1,140,719, almost back to the pre-holiday baseline seen in late summer and early fall. After two elevated months—1,673,872 in November and 1,687,129 in December—January looks less like a stumble and more like a reversion to normal demand.

Over the last six months, the pattern is clear: steady levels from August through October (1,123,617 to 1,148,942), then a seasonal surge in November and December, followed by a January drop. For sellers, that means forecasting based on November–December is risky; those months can inflate expectations and inventory decisions.

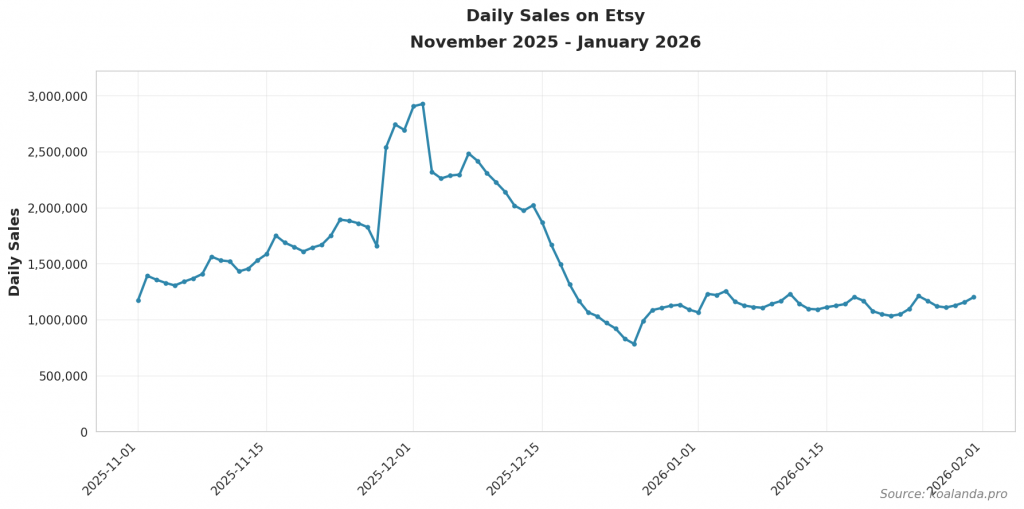

Daily sales data also shows how quickly the market cooled once shipping deadlines and gifting urgency passed. December started extremely high (over 2,900,000 sales on December 1–2) and then slid consistently toward late-month lows, while January stayed mostly in a tighter band around roughly 1,050,000–1,250,000 per day, with fewer dramatic spikes.

Sales on Etsy by category in January

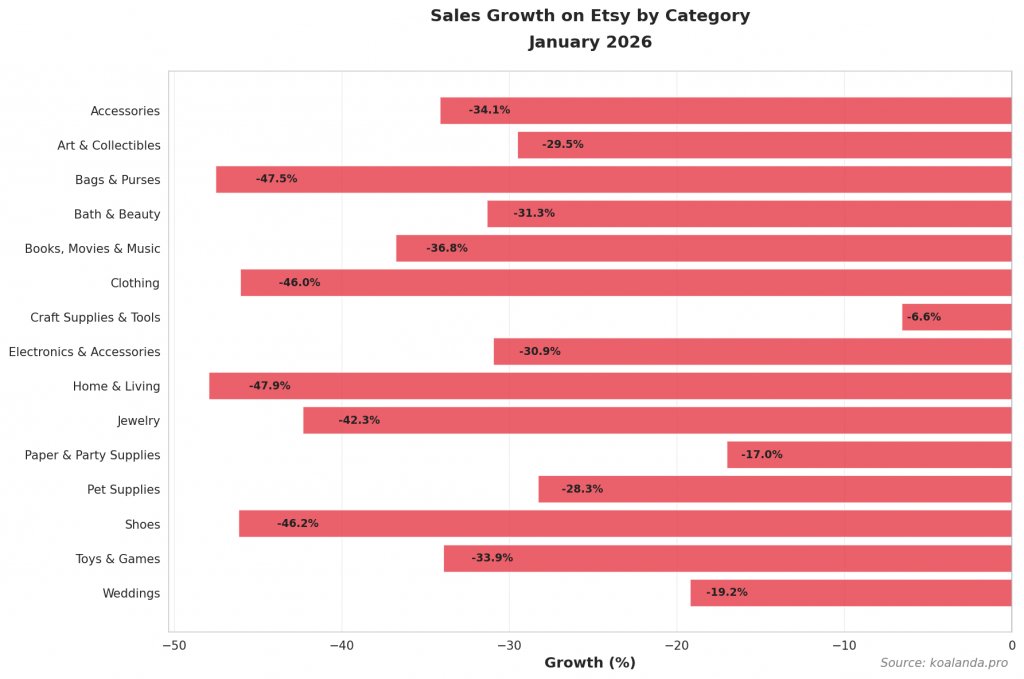

Every major category declined month over month, but the degree of decline is the signal worth reading. Craft Supplies & Tools had the smallest drop at -6.6%, while Home & Living fell -47.9%, and several fashion-adjacent categories dropped in the mid-40% range (for example, Clothing -46.0% and Bags & Purses -47.5%). This suggests buyers kept spending on “make-it” inputs more than “buy-it” finished goods right after the holidays.

By volume, the same categories still dominate the marketplace. Craft Supplies & Tools led with 7,360,067 sales, followed by Home & Living at 6,557,637, and Paper & Party Supplies at 5,459,877. Even with steep declines, these categories remain the demand centers on Etsy, which matters because competing where demand is highest often means competing where seller density is also highest.

The implication for sellers is tactical: January rewards listings aligned to practical needs, replenishment, and planning. Craft supplies and party-related purchases often tie to New Year projects, organization, and upcoming events, while discretionary décor and fashion purchases tend to slow when buyers are recovering from Q4 spend and dealing with winter bills.

It is very useful to compare your results to your competitor shops. With Koalanda’s competitor research tool you can monitor the sales of each individual shop daily! You can see the sales for the last 30 days or 12 months. Analyzing the reasons for their success is a critical step toward improving the quality of your shop. Register for free at https://koalanda.pro/signup to explore Koalanda’s competitor research tools.

Sales on Etsy by country in January

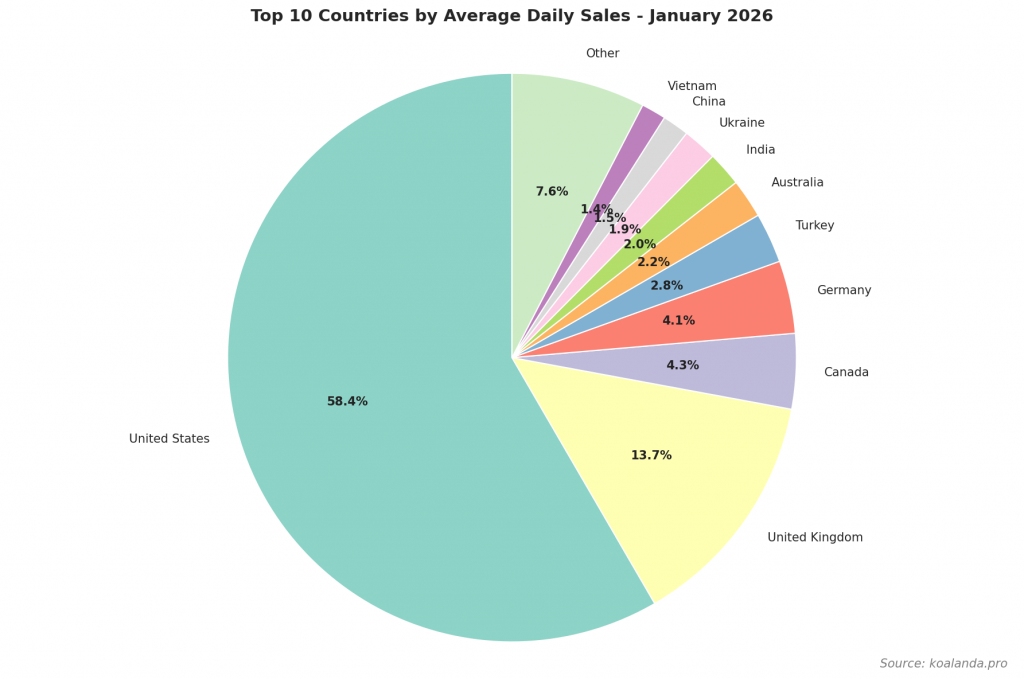

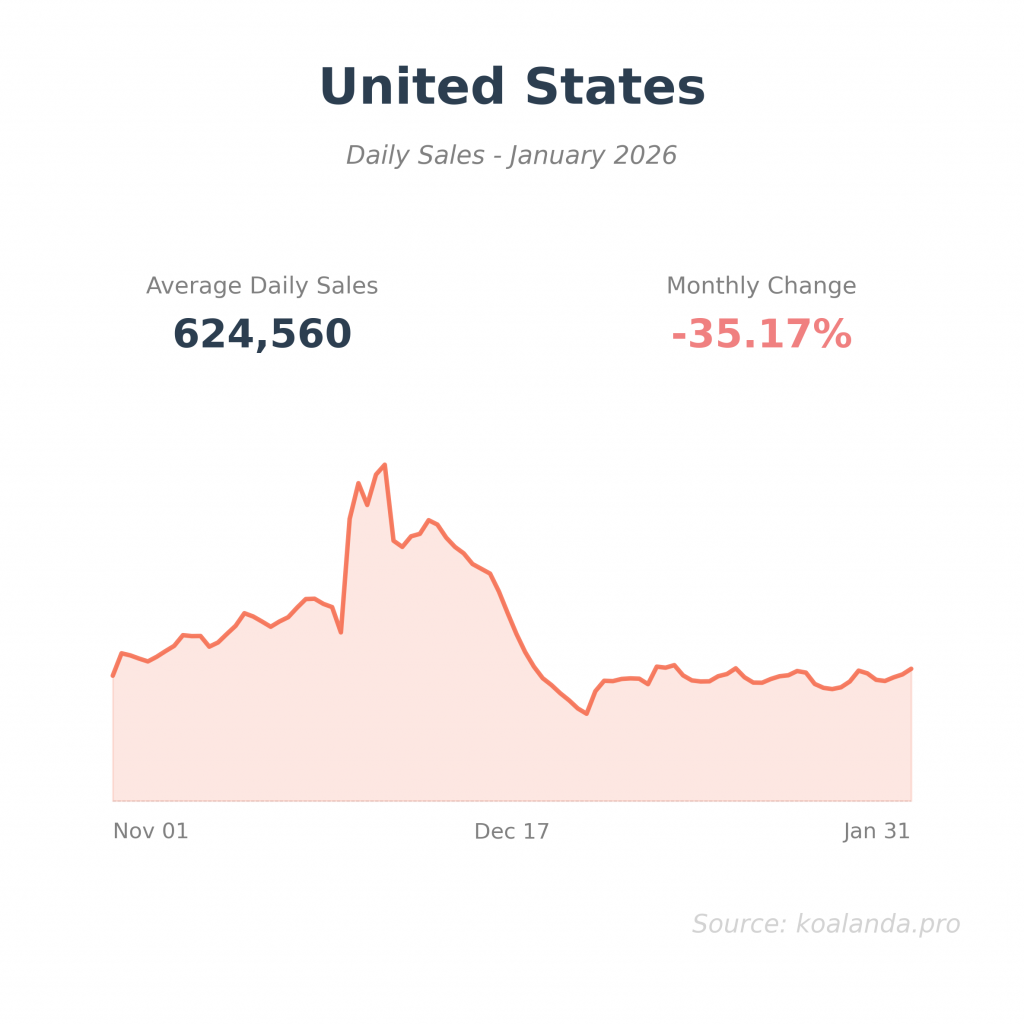

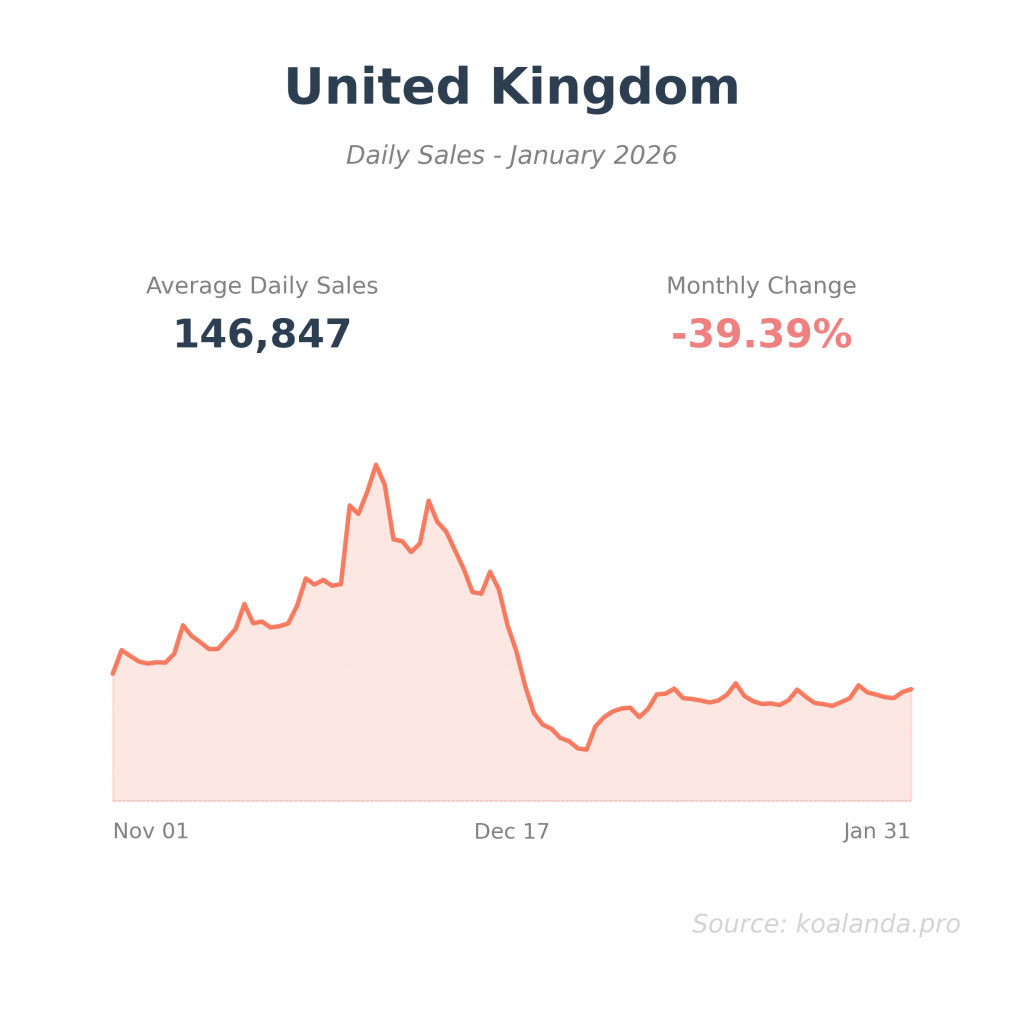

The United States remains the engine of Etsy sales volume, with 19,361,371 total sales and 624,560 average daily sales, but it also saw a steep -35.2% decline. The United Kingdom followed with 4,552,271 total sales and an even sharper -39.4% drop, showing that Etsy’s largest English-speaking markets cooled hard after December.

A key nuance is resilience outside the biggest markets. India posted the smallest decline among the top 10 at -7.5%, and China also held up relatively better at -11.5%. Meanwhile, Vietnam fell -41.0%, indicating that some export-heavy or trend-dependent segments may have been more exposed to the post-holiday demand drop.

For sellers, geography matters in two ways: where your shop is based (and therefore counted here), and where your buyers are. When core markets cool, international diversification can stabilize revenue, but only if your shipping, processing times, and pricing strategy support it. January is also when delivery speed and customer service differentiation can win share, because buyers are less deadline-driven and more selective—meaning weak value propositions are punished faster.

Newly opened shops on Etsy in January

Etsy saw 126,062 new shops opened in January 2026.

Top 10 most successful Etsy sellers in January

The 10 shops with the highest number of sales on Etsy in January 2026 were:

| Rank | Etsy Shop | Monthly Sales | Country | Category |

|---|---|---|---|---|

| 1 | SeedCult | 39,656 | United States | Craft Supplies & Tools |

| 2 | WarungBeads | 32,199 | United States | Craft Supplies & Tools |

| 3 | SilverRainSilver | 31,628 | United Kingdom | Jewelry |

| 4 | CaitlynMinimalist | 29,911 | United States | Jewelry |

| 5 | SeedGeeks | 27,898 | United States | Craft Supplies & Tools |

| 6 | OuferJewelry | 22,650 | United States | Jewelry |

| 7 | PaperSceneCo | 22,379 | United Kingdom | Paper & Party Supplies |

| 8 | MJsOffTheHookDesigns | 22,216 | Canada | Craft Supplies & Tools |

| 9 | SeedTherapy | 19,815 | United States | Craft Supplies & Tools |

| 10 | LittleBirdieCanada | 19,578 | Canada | Paper & Party Supplies |

Explore the top-selling and trending Etsy shops for free and without registration with Koalanda. In Koalanda you can browse the most complete catalog of Etsy shops on the internet, updated daily.

Holidays

The next few months bring several demand opportunities, but they behave differently than Q4. Valentine’s Day (February 14) tends to concentrate purchases into a short window, rewarding ready-to-ship listings, clear gifting language, and personalization options that don’t add long processing delays. International Women’s Day (March 8) can lift certain giftable categories, while Easter (April 5, 2026) and spring celebrations often boost décor, party supplies, and seasonal items earlier than many sellers expect.

The practical takeaway is to plan backward from delivery, not from the holiday date. In January, buyers are planning; in February and March, they act quickly. If your listings are not indexed, photographed, and reviewed early, you’re forced to compete on price or ads later—two levers that can erode margins in a slower season.