November 2025 was the month when Etsy’s holiday engine finally kicked into full gear. In this Etsy Sales Report for November 2025, we see a sharp jump in activity: average daily sales climbed to 1,673,872, up 45.7% from October, pushing total monthly orders to roughly 50.2 million. Not all categories and markets benefited equally, but the data paints a clear picture: holiday demand is here, jewelry and home-oriented goods are booming, and English-speaking markets continue to dominate the platform.

Table of Contents

Sales on Etsy in comparison with previous months

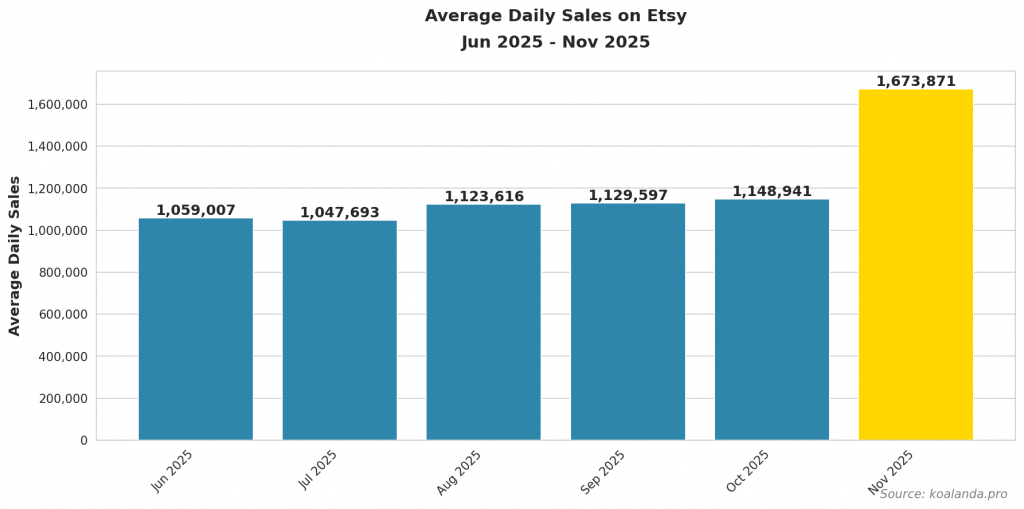

Etsy’s average daily sales rose from 1,148,942 in October to 1,673,872 in November, a very strong 45.7% month-over-month increase. This is one of the steepest jumps of the year and is clearly tied to holiday shopping, Black Friday, and early Christmas buying. For sellers, November is no longer just a “ramp up” month – it is already peak season.

Looking at the last six months, the marketplace had been largely flat, hovering around 1.05–1.15 million average daily sales from June to October. November breaks this plateau decisively, with a level roughly 58% higher than June’s 1,059,007 daily orders. This suggests that the baseline demand hasn’t grown dramatically month to month, but holiday seasonality is still a powerful demand shock.

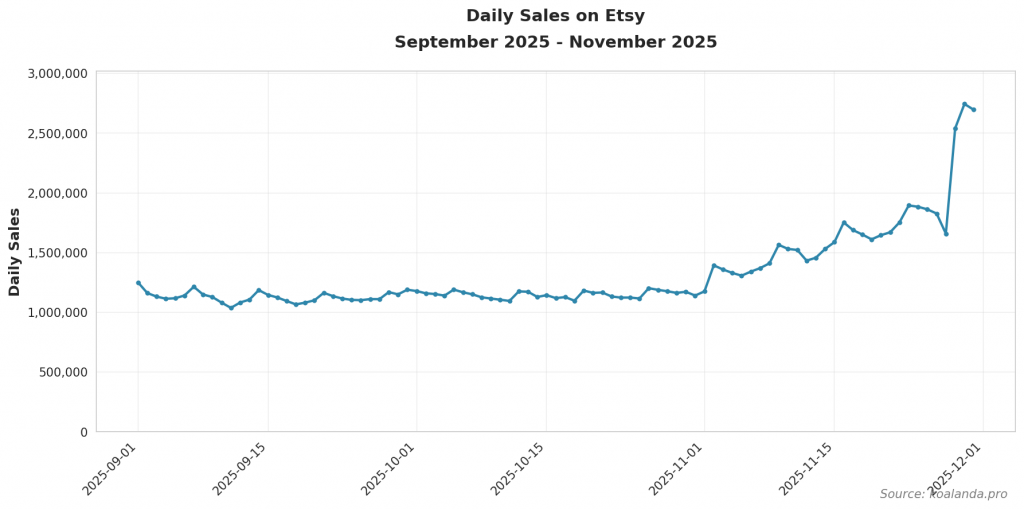

The daily sales chart for November also matters. Peaks around key promotion dates likely concentrate a big portion of monthly revenue into a handful of days. Sellers who were well-prepared with stock, discounts, and fast shipping for those windows likely captured a disproportionate share of this growth, while less prepared shops may have seen only modest improvement despite the strong market.

Sales on Etsy by category in November

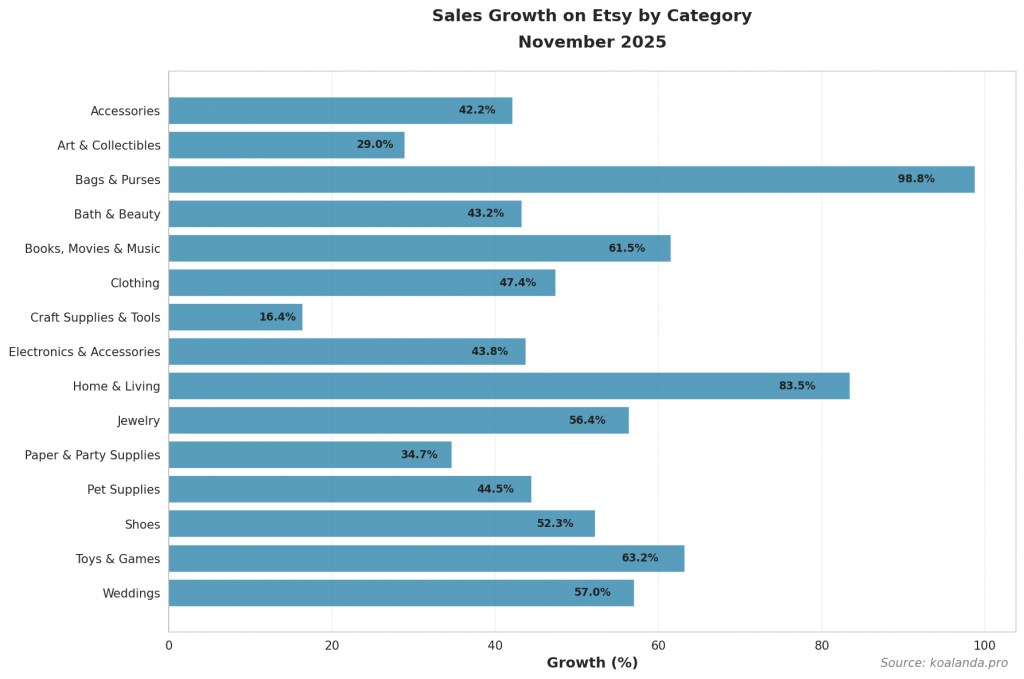

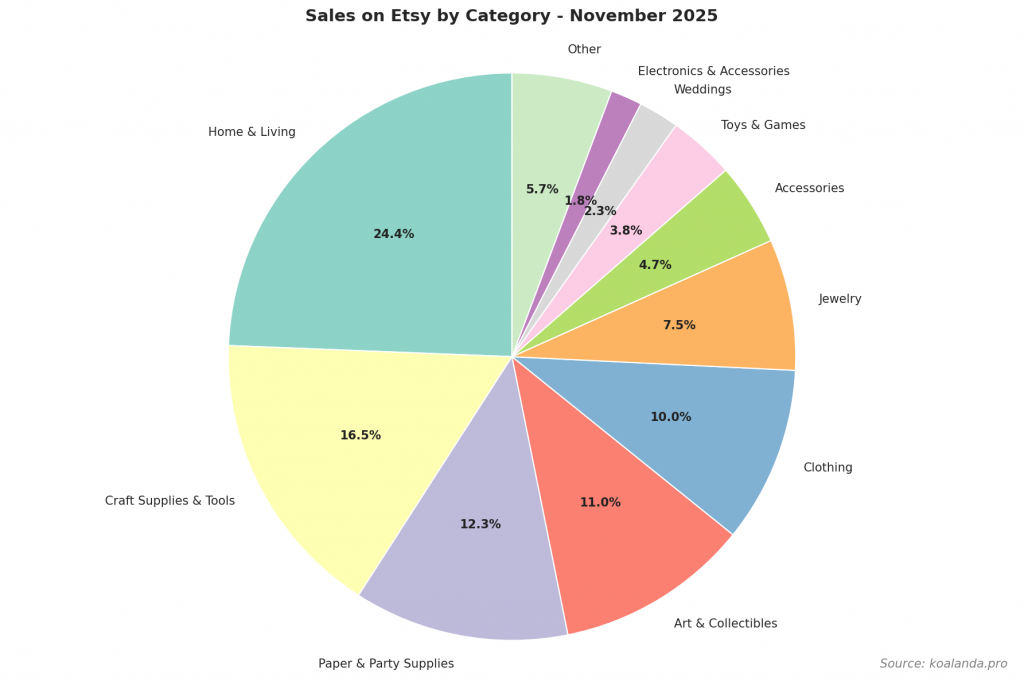

In terms of growth, some categories exploded. Bags & Purses led with 98.8% month-over-month growth, followed by Home & Living at 83.5%, and Toys & Games at 63.2%. This mix reflects typical Q4 behavior: buyers look for gifts, cozy home updates, and family-oriented products. Even traditionally slower categories like Books, Movies & Music grew 61.5%, benefiting from gift buying and niche collectors.

However, growth and volume are not the same story. Home & Living was both fast-growing and the top category by total sales, with 12,225,509 orders in November. Craft Supplies & Tools followed with 8,292,054 sales but only 16.4% growth, which suggests that supplies had already been purchased earlier in the year and in October for holiday production. Paper & Party Supplies (6,148,371 sales) and Art & Collectibles (5,539,613 sales) also occupied strong positions, confirming Etsy’s role as a platform for decor, stationery, and personalized gifts.

At the other end, Shoes remained the smallest category with 98,861 sales despite a respectable 52.3% growth rate. Bags & Purses, while leading in growth, still accounted for only 735,068 sales, placing it in the lower half by volume. For sellers in smaller but fast-growing niches like these, the opportunity is clear: competition is still limited compared to mega-categories, but demand is heating up quickly.

It is very useful to compare your results to your competitor shops. With Koalanda’s competitor research tool you can monitor the sales of each individual shop daily! You can see the sales for the last 30 days or 12 months. Analyzing the reasons for their success is a critical step toward improving the quality of your shop. Register for free at https://koalanda.pro/signup to explore Koalanda’s competitor research tools.

Sales on Etsy by country in November

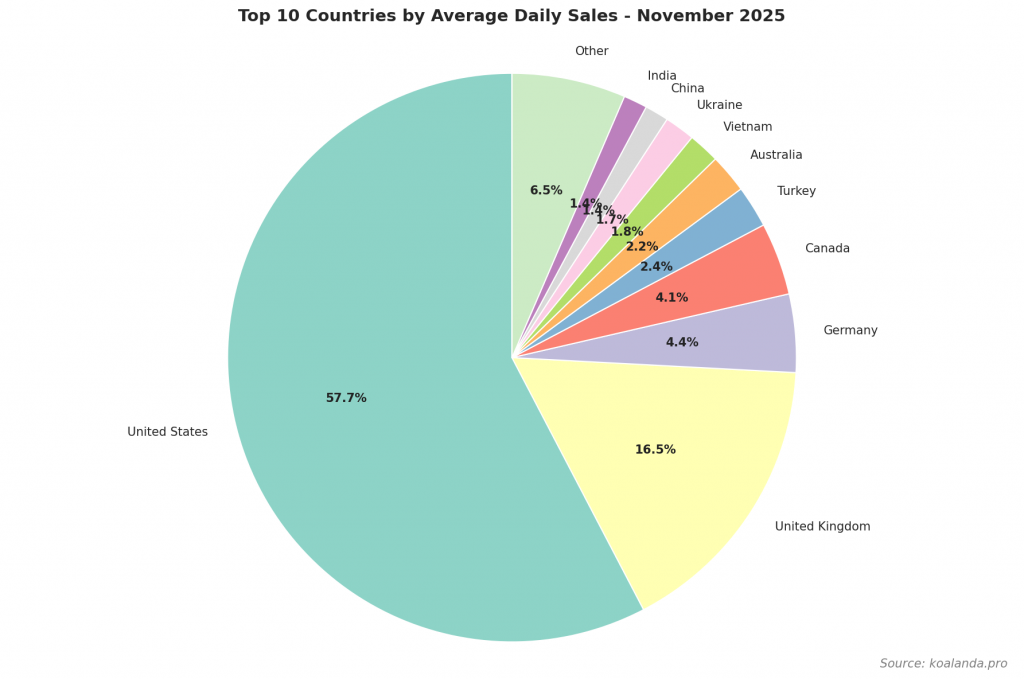

The top 10 countries generated 44,144,631 sales, a huge share of the roughly 50.2 million marketplace total. The United States remains dominant with 27,397,837 sales and an average of 913,261 orders per day, up 43.4% month-over-month. This confirms that Etsy is still heavily dependent on US buyers, and US-focused positioning (pricing in USD, shipping options, US-oriented holidays) continues to be critical.

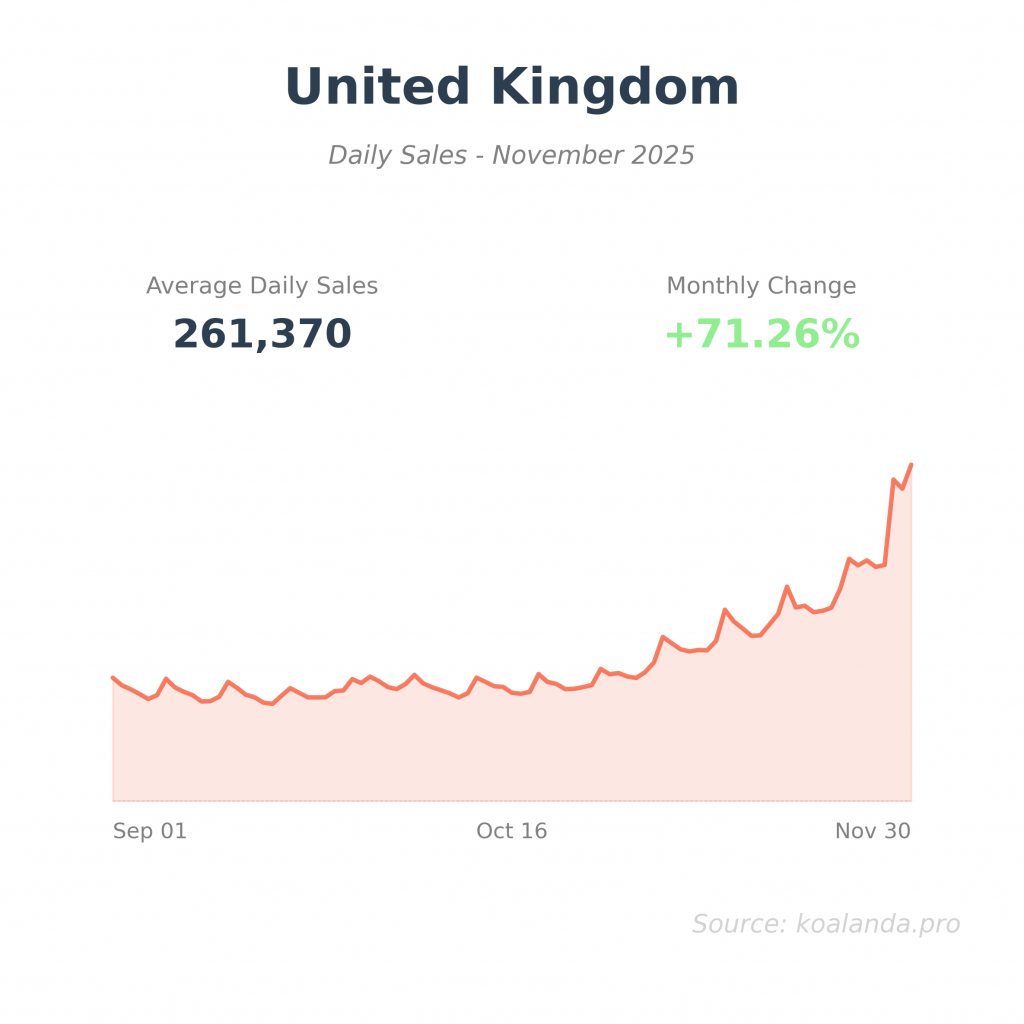

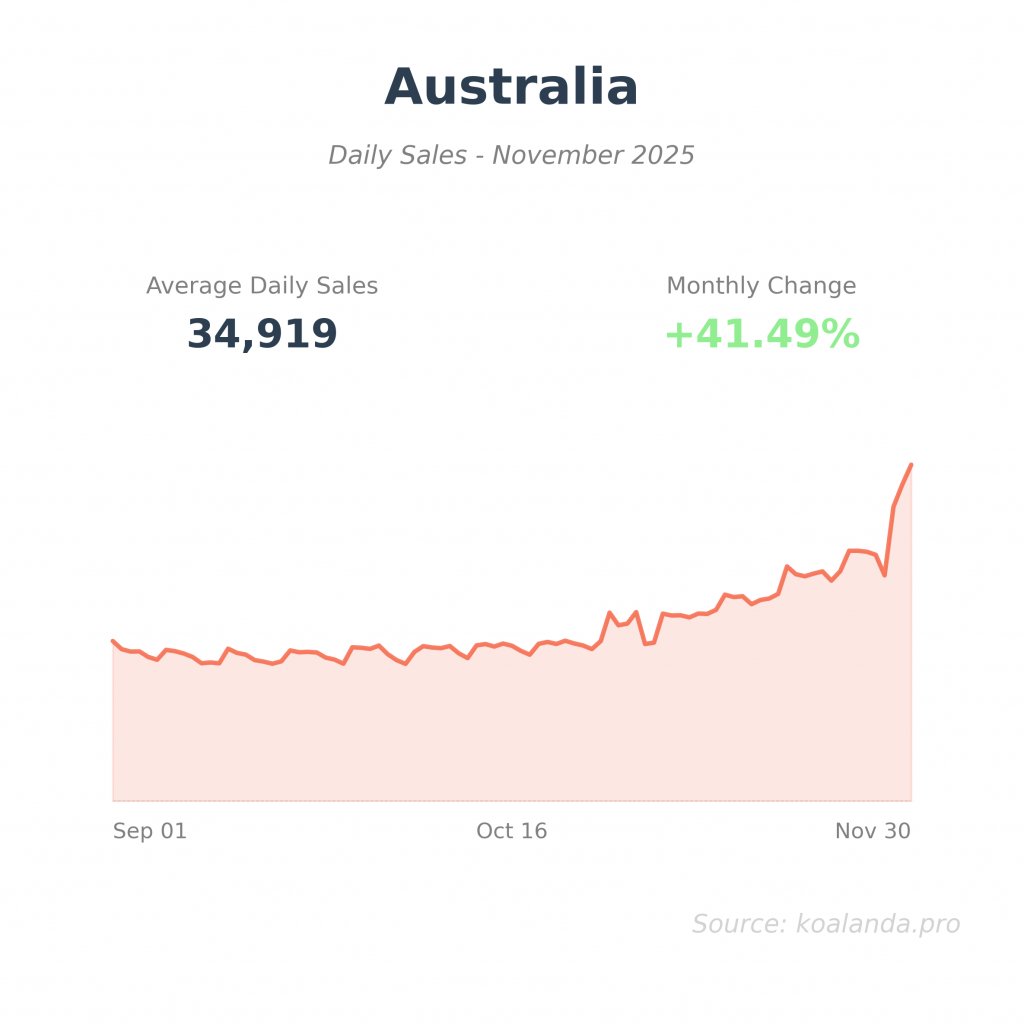

The United Kingdom stands out as the most dynamic major market. With 7,841,107 total sales and 261,370 average daily orders, UK sales grew by an impressive 71.3% compared to October. France also posted strong momentum with 56.5% growth, while Germany (53.3%), Canada (54.0%), and Australia (41.5%) all showed robust holiday acceleration. For European and Commonwealth-based sellers, this broad-based strength across multiple English-speaking and EU markets is a positive signal for cross-border expansion.

Emerging and price-sensitive markets are growing, but more moderately. Turkey (+22.6%), India (+23.0%), Ukraine (+31.6%), and China (+36.8%) are all contributing meaningful volumes, though they still trail far behind the US and UK in total orders. For sellers, these countries are interesting for niche targeting or digital products, but they should still be seen as secondary markets compared to the main anglophone economies during peak season.

Newly opened shops on Etsy in November

In November, 100,510 new shops were opened on Etsy, adding another wave of competition – and potential partners – just in time for the holidays.

Top 10 most successful Etsy sellers in November

The 10 shops with the highest number of sales on Etsy in November 2025 were:

| Rank | Etsy Shop | Monthly Sales | Country | Category |

|---|---|---|---|---|

| 1 | SilverRainSilver | 60,558 | United Kingdom | Jewelry |

| 2 | Lamoriea | 47,981 | United Kingdom | Home & Living |

| 3 | CaitlynMinimalist | 44,184 | United States | Jewelry |

| 4 | WarungBeads | 37,364 | United States | Craft Supplies & Tools |

| 5 | MJsOffTheHookDesigns | 34,419 | Canada | Craft Supplies & Tools |

| 6 | RobertSeCo | 33,088 | United States | Weddings |

| 7 | CraftsByAden | 29,091 | United Kingdom | Weddings |

| 8 | BrianaKdesigns | 27,721 | United States | Craft Supplies & Tools |

| 9 | ArrowGiftCoLtd | 25,338 | United Kingdom | Paper & Party Supplies |

| 10 | PaperSceneCo | 24,837 | United Kingdom | Paper & Party Supplies |

Explore the top-selling and trending Etsy shops for free and without registration with Koalanda. In Koalanda you can browse the most complete catalog of Etsy shops on the internet, updated daily.

Holidays

November’s surge is only the beginning of the peak season. The coming weeks bring Christmas, New Year’s, and other winter holidays, which typically keep order volumes high through late December. For physical products, this is the last window where shipping cut-offs matter; shops that clearly communicate delivery deadlines and offer gift-ready packaging can still convert late buyers who are nervous about timing.

Looking a bit further ahead, Valentine’s Day, early-spring weddings, and spring religious holidays will shape demand in January and February. Personalized jewelry, romantic gifts, wedding decor, and printable cards are likely to remain strong. Sellers should use their November and December performance to identify best-selling listings, then refresh photos, titles, and keywords around themes like “Valentine gift,” “wedding decor,” and “Mother’s Day gift” so they are already optimized when the next demand wave hits.