December 2025 closed the year with solid but not spectacular growth on Etsy. Average daily sales reached 1,687,129 sales, only slightly above November, but far ahead of mid-year levels. This Etsy Sales Report for December 2025 looks at how the platform performed compared with previous months, which categories and countries drove results, how many new shops joined, and who the top sellers were. For Etsy sellers, the data confirms that demand is there, but competition and seasonality are shaping where and how buyers spend.

Table of Contents

Sales on Etsy in comparison with previous months

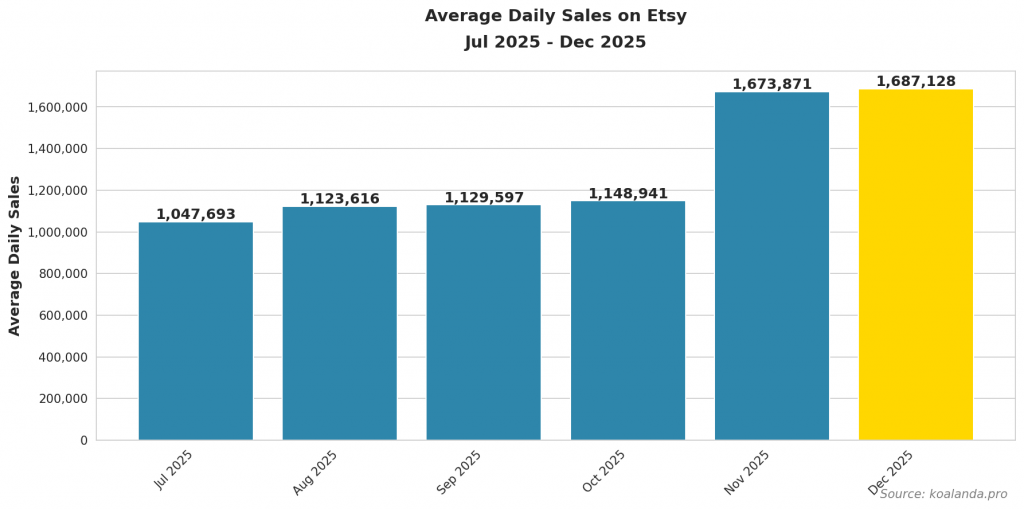

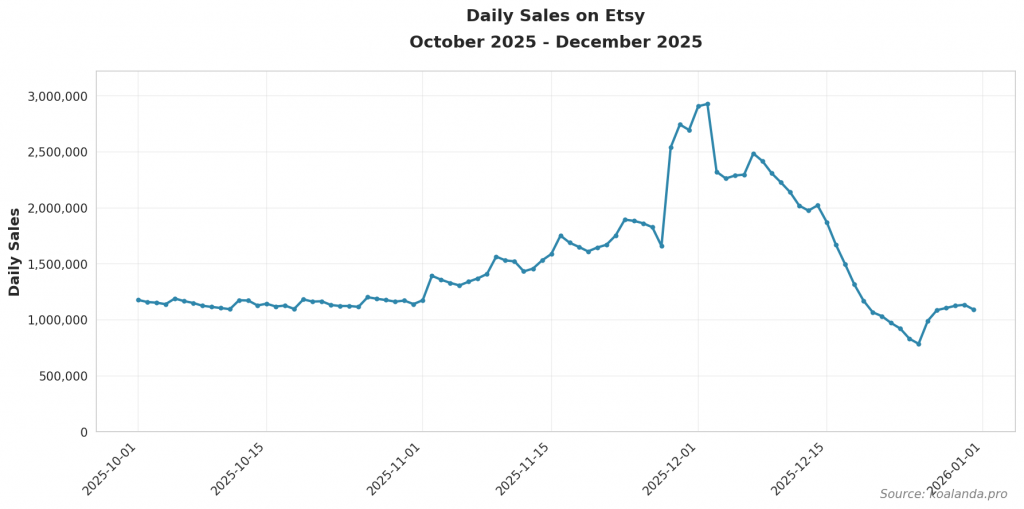

In December 2025, Etsy recorded an average of 1,687,129 daily sales, just above November’s 1,673,872. That translates into a modest 0.8% month-over-month increase. For what is usually the peak of the holiday season, this is growth, but not an explosive surge. It suggests that much of the holiday shopping was already captured in November, when buyers took advantage of early promotions and shipping deadlines.

Looking back over the last six months, the trend is clearer. In July, average daily sales were 1,047,694, rising steadily through August (1,123,617), September (1,129,597), and October (1,148,942). The big jump came in November, when daily sales leaped to 1,673,872, and December then added only a small incremental gain. The charts for average daily sales and daily fluctuations show a marketplace that ramped up sharply into the holiday peak and then stabilized rather than spiking further.

For sellers, this matters in two ways. First, it confirms that Q4 remains crucial, but the shopping peak is spreading across both November and December. Second, it implies that relying only on late-December traffic is risky. Shops that prepared listings, inventory, and ads early for November likely captured the strongest demand, while December rewarded those with strong fulfillment, last-minute gifts, and digital products.

Sales on Etsy by category in December

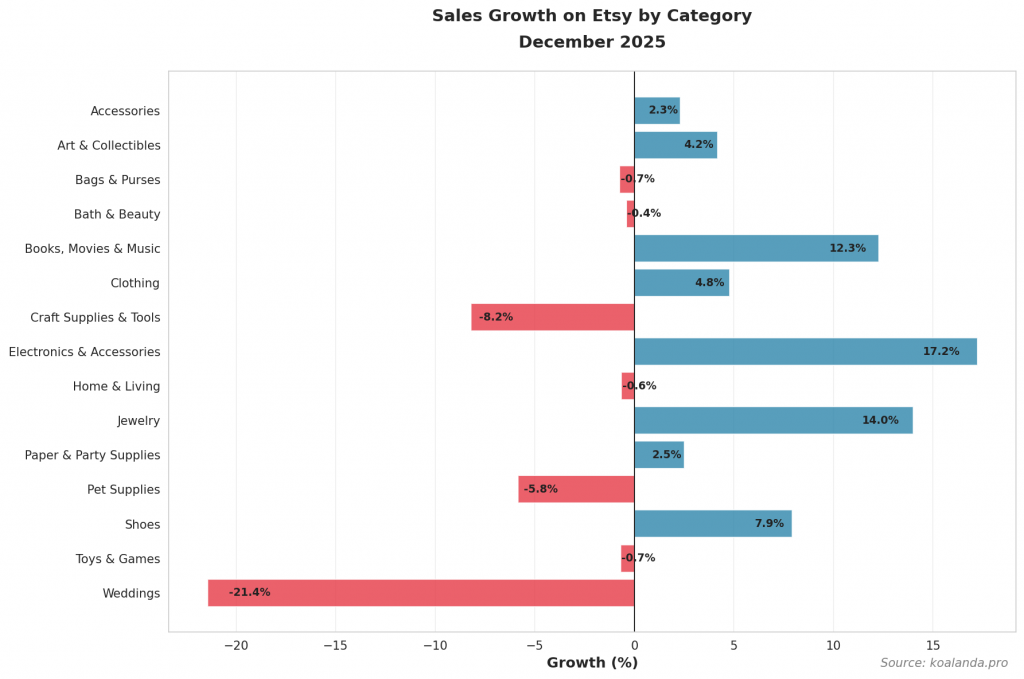

Category performance in December was uneven, with a clear divide between gift-friendly, impulse-ready segments and more seasonal or budget-sensitive ones. The fastest growth came from Electronics & Accessories with 17.2% month-over-month growth, followed by Jewelry at 14.0% and Books, Movies & Music at 12.3%. These categories align well with holiday gifting: personal tech accessories, personalized jewelry, and entertainment or collectible media often perform well as affordable presents. Sellers in these niches benefited from timely product positioning and strong gifting keywords.

At the same time, overall volume still rests in the classic Etsy pillars. Home & Living remained the largest category with 12,719,117 total sales in December. It was followed by Craft Supplies & Tools (7,835,881), Paper & Party Supplies (6,550,463), Art & Collectibles (5,891,062), and Clothing (5,400,057). Even when some of these categories had modest or negative growth, their sheer size means they continue to shape the marketplace. A small percentage change in a big category still represents a large shift in absolute sales.

Not all segments benefited from the holiday season. Weddings plunged by 21.4%, while Craft Supplies & Tools fell 8.2%, Pet Supplies dropped 5.8%, and categories like Toys & Games, Bags & Purses, and Home & Living showed slight declines. This likely reflects a combination of seasonality (weddings and some crafting are weaker in winter) and buyers prioritizing gifts over supplies or non-essential purchases. For sellers, the lesson is to plan category-specific calendars: Wedding and supply shops should lean into early-year planning, spring, and summer, while gift-oriented categories can build heavily toward Q4.

It is very useful to compare your results to your competitor shops. With Koalanda’s competitor research tool you can monitor the sales of each individual shop daily! You can see the sales for the last 30 days or 12 months. Analyzing the reasons for their success is a critical step toward improving the quality of your shop. Register for free at https://koalanda.pro/signup to explore Koalanda’s competitor research tools.

Sales on Etsy by country in December

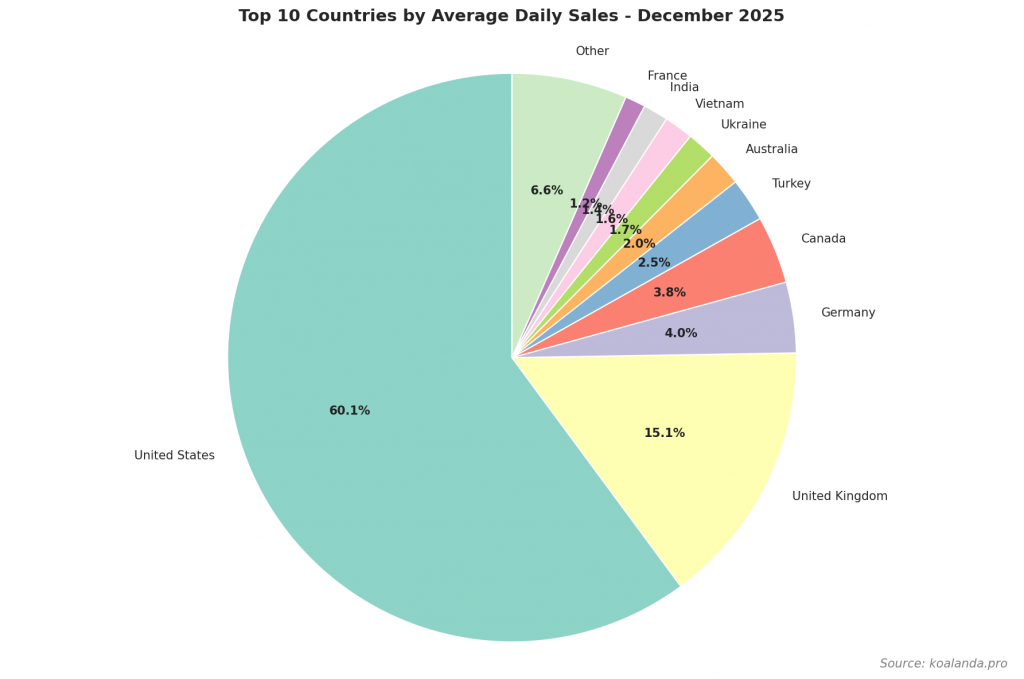

Etsy remains heavily dominated by the United States, which recorded 29,814,129 total sales in December, or 961,746 average daily sales, with a 5.3% growth rate. This means roughly more than half of all Etsy sales still come from U.S. based shops.

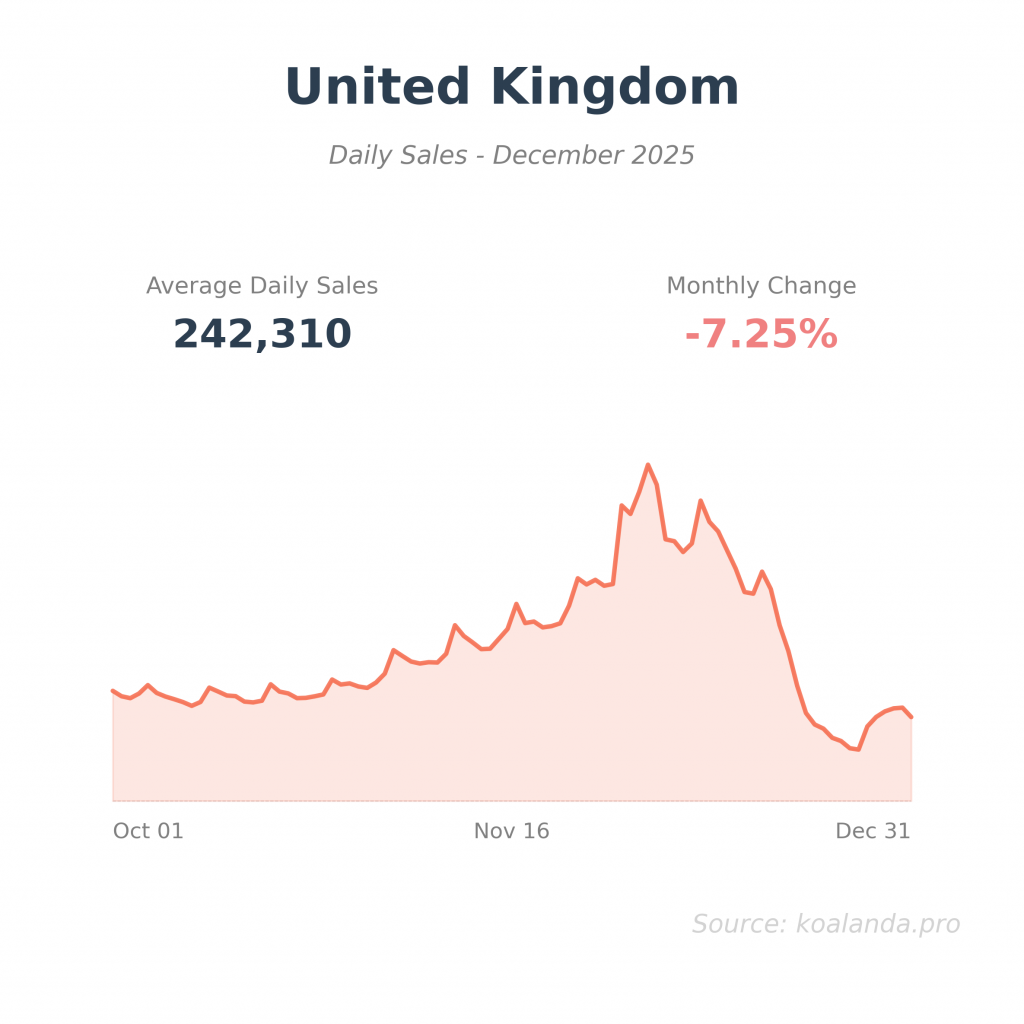

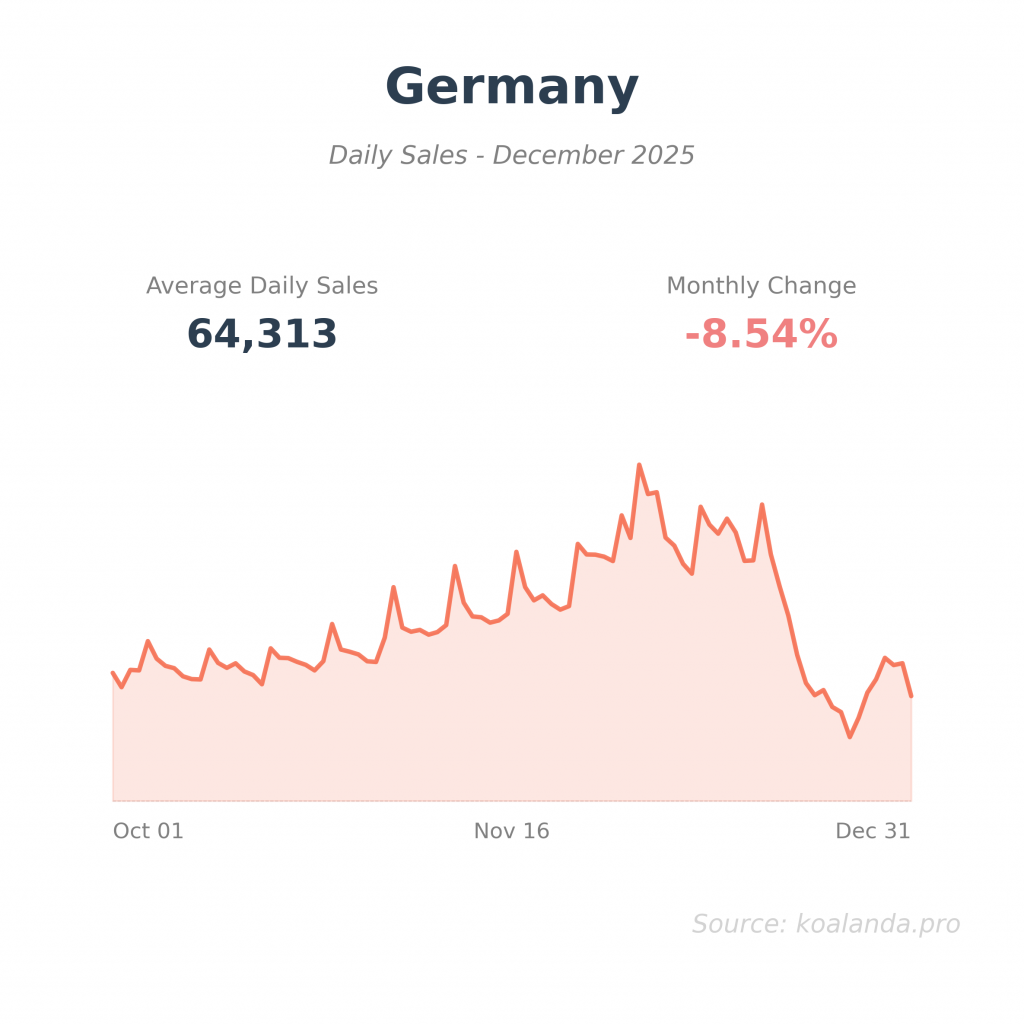

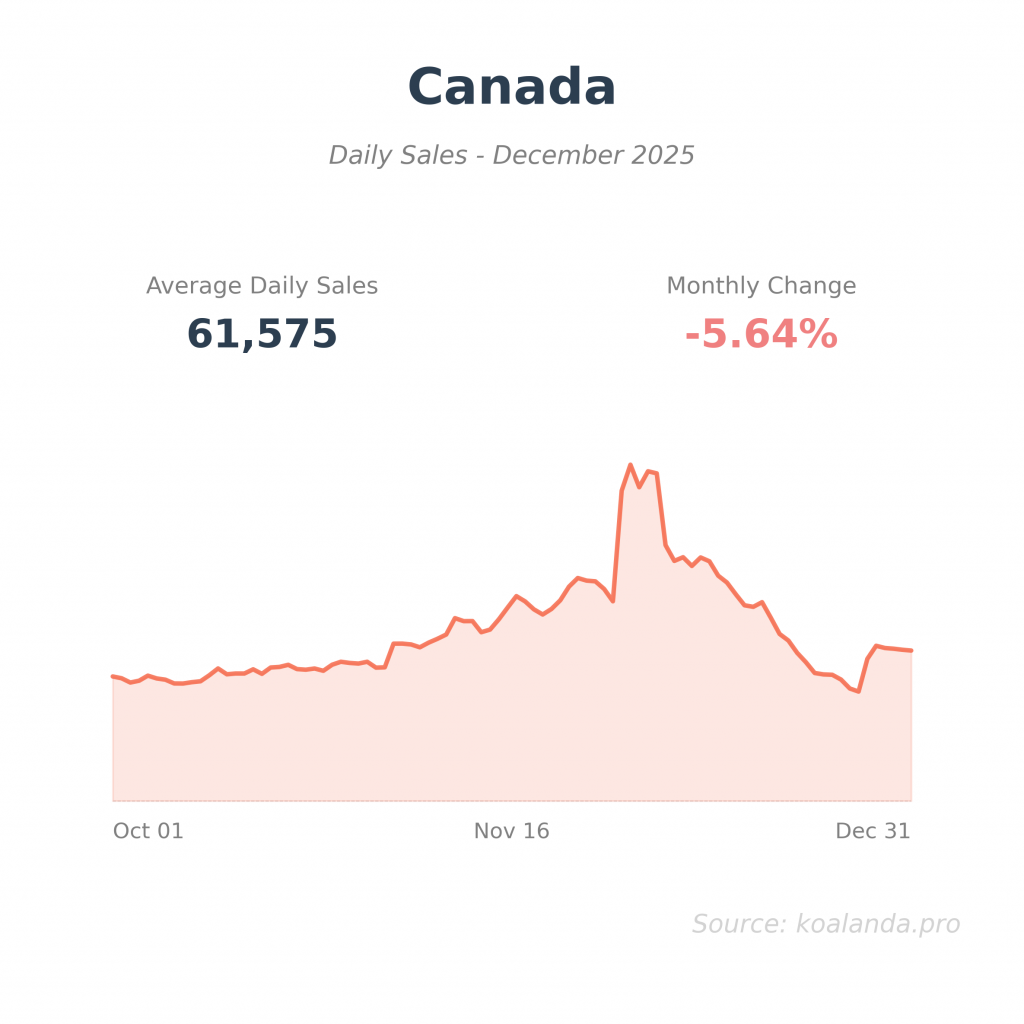

The United Kingdom stayed firmly in second place with 7,511,620 total sales and 242,310 average daily sales, but saw a 7.2% decline compared with the previous month. Other mature markets also contracted: Germany fell 8.5%, Canada 5.6%, Australia 10.6%, and Vietnam 6.6%. This suggests that in some regions, the holiday surge came earlier, or that macroeconomic pressures and currency fluctuations may be dampening demand. Sellers heavily reliant on these markets might feel increased price sensitivity and need to optimize shipping and promotions more aggressively.

In contrast, several emerging or fast-developing markets grew. Turkey delivered 1,227,363 total sales (39,592 daily) with 5.0% growth, while India reached 705,657 total sales (22,763 daily) and posted a strong 6.6% growth. The U.S. and these growing markets provided the main positive momentum in December. For sellers, this highlights an opportunity: localizing listings, offering suitable shipping options, and adjusting product assortments for markets like Turkey and India can capture incremental demand while some traditional Western markets cool down.

Newly opened shops on Etsy in December

In December 2025, 91,377 new Etsy shops were opened, underscoring that competition on the platform continues to intensify even during the busiest season.

Top 10 most successful Etsy sellers in December

The 10 shops with the highest number of sales on Etsy in December 2025 were:

| Rank | Etsy Shop | Monthly Sales | Country | Categry |

|---|---|---|---|---|

| 1 | SilverRainSilver | 70,690 | United Kingdom | Jewelry |

| 2 | CaitlynMinimalist | 54,360 | United States | Jewelry |

| 3 | PaperSceneCo | 49,145 | United Kingdom | Paper & Party Supplies |

| 4 | WarungBeads | 34,575 | United States | Craft Supplies & Tools |

| 5 | ModPawsUS | 29,067 | United States | Pet Supplies |

| 6 | PersonalizationMall | 27,552 | United States | Home & Living |

| 7 | MJsOffTheHookDesigns | 26,168 | Canada | Craft Supplies & Tools |

| 8 | LittleBirdieCanada | 24,666 | Canada | Paper & Party Supplies |

| 9 | OuferJewelry | 23,389 | United States | Jewelry |

| 10 | Lamoriea | 22,256 | United Kingdom | Jewelry |

Explore the top-selling and trending Etsy shops for free and without registration with Koalanda. In Koalanda you can browse the most complete catalog of Etsy shops on the internet, updated daily.

Holidays

With December behind us, the next few months bring a shift from broad holiday gifting to event-driven and relationship-driven buying. January is usually quieter, as buyers recover from seasonal spending and returns. This makes it a good month for Etsy sellers to analyze their December performance, refresh listings, improve photography and SEO, and plan inventory. At the same time, early promotion of Valentine’s Day products can capture shoppers who start looking for gifts well before mid-February.

Looking further ahead into late winter and spring, sellers should prepare for Mother’s Day, graduation season, and the early stages of wedding season. Categories like Jewelry, Clothing, Paper & Party Supplies, Weddings, and Home & Living typically benefit from these events. Shops that tailor their keywords, product lines, and marketing calendars to these holidays can smooth out the post-December slowdown and build more stable, year-round revenue. In short, December 2025 delivered strong overall performance, but the real opportunity for Etsy sellers is to use this data to plan smarter for the next wave of seasonal demand.